1. Local taxes and import duties

Local taxes and import duties may be incurred in some countries and are not included in the amounts shown. The buyer or recipient of the shipment is responsible for all such taxes and duties. Our products are sold worldwide and we cannot guarantee that they meet the import requirements of every country. If in doubt, please check with your country's customs office prior to ordering.

2. How to get tax less or free upon import

Any import charges or fees are the buyer's responsibility. In order to ensure you receive your order tax less or free upon import, we will declare it with a lower value. This lower price does not reflect the total price you paid or the market value of the product and may not apply to countries with different tariff rules. If need to use the true value, or any other requests, please write down on the "Remark" part when you order or email us.

3. The EU VAT Reforms Effective 1 July 2021

Effective 1 July 2021, there are significant changes to the European Union's Value Added Tax (VAT) rules impacting imports into the EU valued up to EUR 150.

The VAT exemption at importation of small consignments of a value up to EUR 22 will be removed. This means all goods imported in the EU will now be subject to VAT.

All receivers will be charged VAT ((value of goods+shipping cost)*VAT rate) and a €8 disbursement fee (UPS customs clearance fee) when receiving, and we will declare the value of goods as low as possible. The period of customs clearance will be longer than before.

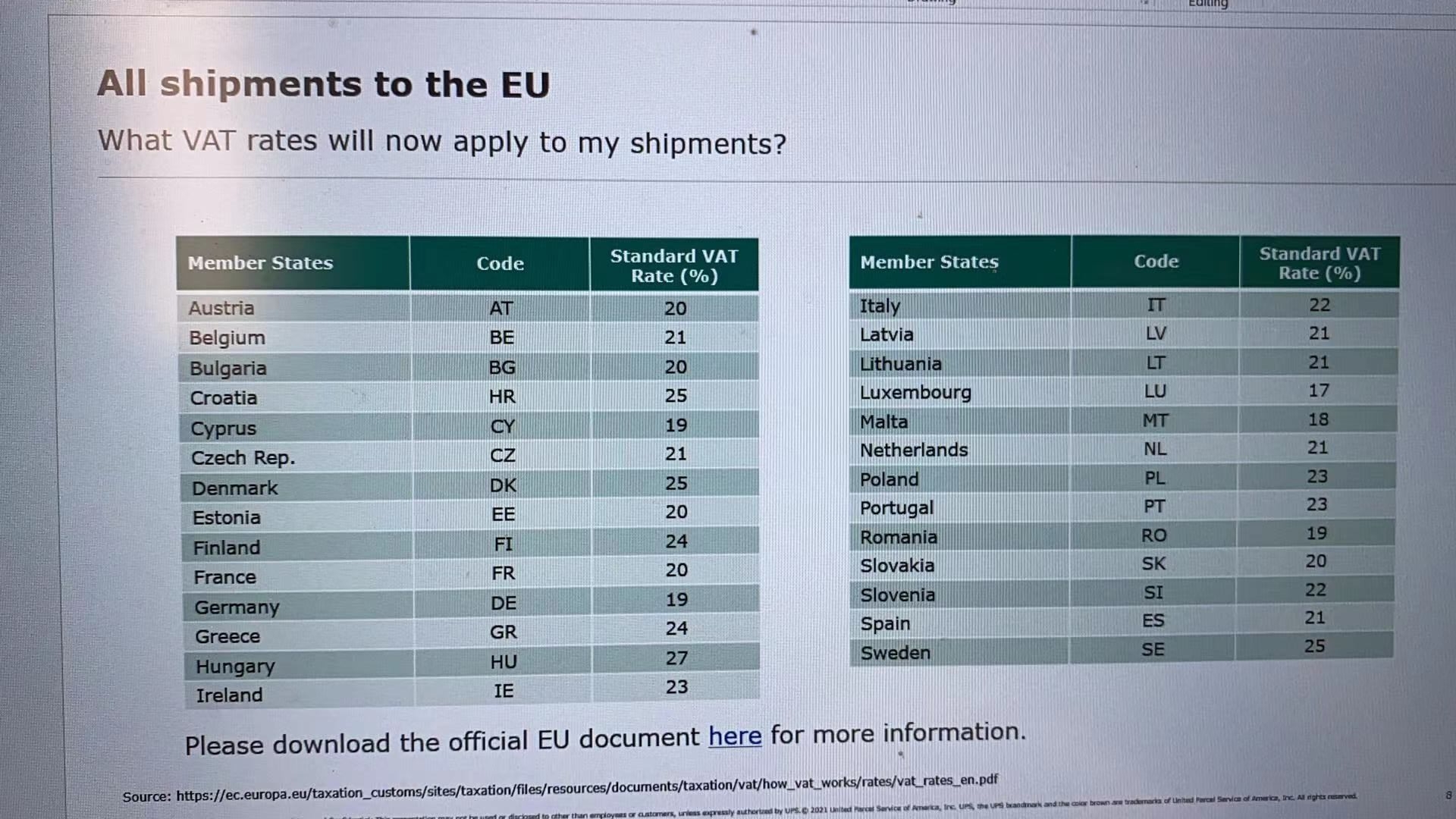

VAT rate of EU member states:

More about the EU VAT rules, please visit https://ec.europa.eu/taxation_customs/business/vat/vat-e-commerce_en